- Articles ›

- Marketing and Strategy ›

- Indian Rural Market: The Next Big Thing Articles

Indian Rural Market: The Next Big Thing

The Indian rural market has gained significance in the recent times as the overall economic growth of the country has led to an improvement in the living standards of the rural people. The boon of the Green Revolution combined with government initiatives such as subsidies, loan waivers, minimum support prices (MSP) and employment schemes (MGREGS) have caused an increase in purchasing power.

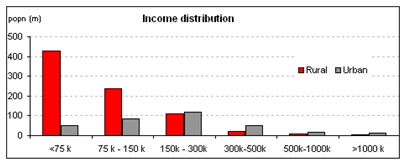

The real income of rural households is projected to rise from 2.8% in the past two decades to 3.6% in the next two. Higher incomes and exposure to urban lifestyles have also raised the aspirations of the rural populace, as they strive to improve their quality of life by gaining access to new technologies, products and services.

Rural India consists of 638596 villages that house 742,490,639 people. This figure represents around 70% of the total population of India and 12% of the globe’s population. In fact, as per Mckinsey, despite rising urbanisation, 63% of India’s population will continue to live in the rural areas even in 2025. Further, the number of consumers earning over $5 a day is projected to catapult from 50 million today to 150 million by 2020.

|

|

No of households (m) |

||

|

Demographic classification |

Urban |

Rural |

Total |

|

Rich ( income greater than Rs 1m per annum) |

4.8 |

1.3 |

6.1 |

|

Well off (income greater than Rs 0.5m per annum) |

29.5 |

27.4 |

56 |

|

Total |

34.3 |

28.7 |

63.0 |

|

% of Total |

54.4% |

45.6% |

|

Source: Ministry of Communications & Information Technology, India

Cut throat competition in urban areas has compelled many companies to look for new, unexploited markets. Rural India has emerged as an answer, owing to lack of strong presence by brands in most sectors as well as a high growth potential. Further, improvement in infrastructure prompted by government initiatives seems to have lowered entry barriers for many companies. Also, rural India is insulated against global economic downturns, which adds to its attractiveness. For companies looking to tap this market, the 4P’s of the Marketing mix have given way to the 4 A’s of Rural Market Mix: Affordability, Awareness, Availability and Acceptability.

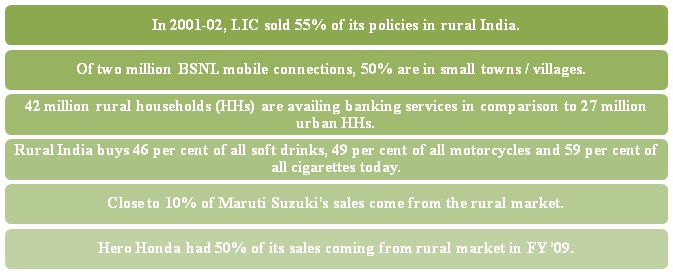

A few interesting figures:

Present Market Scenario:

1. FMCG:

FMCG companies have realized a significant proportion of their sales from rural markets. They account for 70% of toilet soap and 50% of TV, fans, bicycles, tea and wrist watch consumption. At present rural India accounts for 34% in FMCG consumption. HUL has launched special initiatives to push its rural sales through “Project Shakti” and “Shakti Amma” television channel.Successful FMCG products have typically been low priced and available in small-unit packages. This is in line with the rural psychology of high aspiration and high price consciousness. Examples are Parle-G priced at Rs. 2, Chik Shampoos sold in sachets priced at 50 paisa and 500gm packs of Godrej soaps priced at Rs 5.

2. TELECOM:

RNCOS, a research agency, states that as penetration in the urban region has saturated, operators are vying for rural India and estimates that the subscribers’ base in rural markets will grow at a CAGR of 35% during 2011-12 to 2013-14. Mobile device manufacturers are also tailoring their products to this market.

Nokia had earlier launched Nokia 1100 with a torch (large parts of rural India don't have electricity) and an alarm clock. In December 2008, it went one step further with the launch of Nokia Life Tools, which is a range of agriculture, education and entertainment services designed especially for the consumers in rural areas.Reliance Communications in a JV with Handygo Tech Pvt Ltd has introduced a Value Added Service, Behtar Zindagi, providing the people with weather reports, livestock information, mandi prices, fisheries, finance and wealth scheme advisories.

3. RETAIL:

The rural retail market is currently estimated at US$ 112 billion, or around 40 per cent of the Indian retail market. Traditionally, people in rural areas purchase products in haats, mandis and melas, which represent the unorganized retail industry. Today many companies are entering the rural markets with a model for organized retail. Examples include:

- Hariyali Kissan Bazar, promoted by DCM Sriram caters to the requirements of farmers for farm equipments and other agricultural inputs.

- ITC’s Choupal Sagar is another initiative that not only sells personal care and household utility items, but also buys farm produce

- Large format retail stores called “Adhaar” also have been set up by Godrej Agrovet

4. AUTOMOBILES

Rural areas have traditionally been major markets for automobiles such as tractors and cars. But rising incomes and people’s aspirations have led to an increased demand for cars as well. Market leader in the small car segment, Maruti Suzuki India Limited, has registered almost a fifth of its sales from the non-metro areas across the country. Also, Mahindra & Mahindra is now selling more Scorpios in rural and semi-urban markets. The successes of these firms have encouraged others to venture into these markets. Bajaj Auto, the country’s second largest two-wheeler seller, is planning to offer a 150cc engine motorcycle to the rural areas. Another entrant is Toyota Kirloskar Motor,which is planning to sell 40% of its cars in rural markets in India.

5. CONSUMER DURABLES:

Many companies are committed to modify their products to explicitly suit rural demands. For example, lighting solutions company BPL Techno Vision has launched its rechargeable light emitting diode (LED) lantern 'BPL Chirag' for the domestic rural market. Chirag needs only four hours of charging for five hours of light. This product addresses the problems of frequent power losses and fluctuating voltages in rural India.

Challenges:

Although rural India seems to be a huge unexploited market, there are certain deterrents that slow down firms undertaking ventures to tap rural markets. The biggest mistake is to consider the entry into rural markets a natural expansion of the existing urban markets. The requirement of the rural people is significantly different from that of the urban areas, owing to varied demographic, social, economic and psychological environments. Thus the market offerings have to be suitably modified to meet the exact requirements of the rural consumers.

Villages in India are spread over large geographical areas, and sometimes have very low densities of population. About 68% of the market remains untapped due to inaccessibility. This makes the distribution of products and their ready availability challenging. In fact, sales in rural India is influenced more by product availability than by advertisement.

Added to this is the wide prevalence of fake brands, which flourish mainly due to illiteracy and lack of awareness. Local companies often copy the logo and colour schemes of established brands, while slightly modifying the product name in an attempt to fool customers into believing their fake products for the genuine ones.

The disposable income of the rural populace is relatively low as compared to urban areas, seasonal, unstable and affected by uncontrollable factors like floods and droughts. This makes purchase of bulk consumer products rare. Hence people prefer goods that are low priced, or offer a good value for money. Small-unit packets are readily accepted as they represent convenience and affordability.

Purchases in rural India are meant for consumption by the entire family as opposed to individual preferences. In this scenario, it is essential that products are developed such that they are fit for general purpose by all the members. This results in loss of opportunities for firms that gain by customization. On the whole, purchase decisions are influenced by deeply rooted social and cultural norms. The Joint family system is still common, and reference groups have a major impact on buying behaviour. Thoughtful consideration to all these factors is essential to make a mark on the rural audience.

Marketers are often unable to obtain a true picture of the needs and wants of the rural people due to difficulties in conducting market research. Wide geographical spread and vast variation in languages increase the time and costs involved. Moreover, a conservative outlook often restricts women from taking the surveys.

Advertisements and other forms of communication also have to be modified suitably to suit the tastes of the rural people. For example, it has been observed that people respond positively to bold fonts and bright colours such as red, green and yellow. The messages on advertisements should be written keeping in mind the sensitivities of the people and not offend anyone.

Advertising in rural areas tend to be expensive as messages need to be translated in several local dialects to create optimum impact. Today companies are realizing the potential of the Indian rural markets and gradually expanding their steps in this direction. They still have a long way to go, but it is clear that the companies will eventually have to harness the rural markets for growth and opportunity.

This article has been authored by Rubayet Chakraborty & Ahana Chakraborty from NITIE.

Image: dan / FreeDigitalPhotos.net

Views expressed in the article are personal. The articles are for educational & academic purpose only, and have been uploaded by the MBA Skool Team.

If you are interested in writing articles for us, Submit Here

Share this Page on:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

All Business Sections

Write for Us