- Business Concepts ›

- Human Resources (HR) ›

- Net Salary

Net Salary

Definition, Importance & Example

This article covers meaning & overview of Net Salary from HRM perspective.

What is meant by Net Salary?

Net salary is the income which an employee actually gets in hand after all the deductions are done from salary. These deductions include Provident fund, gratuity, superannuation, retirals and most importantly income tax or TDS (Tax deducted at Source). Net salary is also known as Take-Home or in-Hand salary. Gross Salary is also a very similar term but it is different from net salary. It also includes deductions like EPF etc. but it does not include income tax which is included in net salary calculation.

Net Salary Formula Calculation

Net Salary (or Take Home Salary) = CTC (Cost to Company) - EPF (Employee Provident Fund) – Retirals - Deductions – INCOME TAX (TDS)

Net Salary = Gross Salary – Deductions – INCOME TAX (TDS)

Net Salary <= Gross Salary

It is mostly less than Gross Salary. It can be equal in cases in which income tax is 0 and the salary is less than the government tax slab limits.

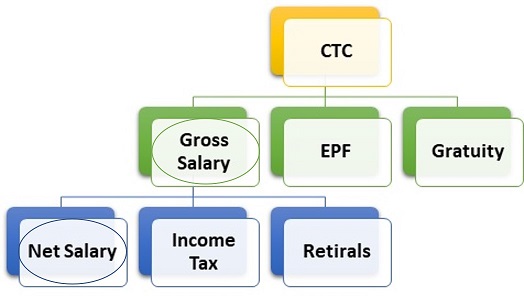

The image shows the relationship in various components of a typical salary structure.

We can see the gross salary and net salary in the above diagram and various components in relation to Cost to Company (CTC). Most of the employers deduct income tax as part of salary credited in bank every month. Based on local tax regulations and calculations, the TDS is deducted when the salary is credited.

So the salary we received normally is net salary.

Importance of Net Salary

It is a very important when it comes to salary calculations. It is the actual money an employee gets to manage his or her individual expenses like bills, EMI, transfers, payments, travel etc. A person starts planning based on the salary credited in bank. It is very important when a CTC offer is made to a prospective employee. Many a times lot of components in the salary structure can be confusing. A person should understand the difference between net salary and gross salary in respect to the offered CTC. If CTC is large but net salary is low then it can lead to problems for employee.

Net Salary Calculation Example

Let us assume Employee John’s CTC per month is 4000$

Components:

Basic Salary: $1500

Provident Fund: 200$

Gratuity: 100$

TA/DA: $400

Conveyance Allowance: $200

Retirals: $200

Bonus: $1200

Medical Allowance: $200

Gross Salary would be 4000-200 (PF)-100 (Gratuity)=3700$

But the net would be 3700-Taxes-Other Deductions

Let us assume Income tax (Including other deductions) is 300$ so the Net Salary would be = 3700-300 = 3400$

Difference between Net Salary and Gross Salary

Net Salary and Gross salary are often used interchangeably but they are different. In the formula calculation and definition above, the difference is evident. Gross Salary is what remains after deducting retirals from one's salary and net salary is what remains after including tax dedications as well.

Hence, this concludes the definition of Net Salary along with its overview.

This article has been researched & authored by the Business Concepts Team which comprises of MBA students, management professionals, and industry experts. It has been reviewed & published by the MBA Skool Team. The content on MBA Skool has been created for educational & academic purpose only.

Browse the definition and meaning of more similar terms. The Management Dictionary covers over 1800 business concepts from 5 categories.

Continue Reading:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

Related Content

All Business Sections

Write for Us